As it is not actually a working capital account, it is omitted from the operating section and included with its corresponding long-term liability account in the financing activities. For example, the opening balance of $325,000 above is the sum of the current portion ($45,000) plus the long-term portion ($280,000). Similarly, the ending balance of $306,000 is the sum of the current portion ($60,000) plus the long-term portion ($246,000). The statement of cash flows above for Wellbourn Services Ltd. is an example of a statement using the direct method. The direct method converts each item on the income statement to a cash basis. For instance, assume that sales are stated at $100,000 on an accrual basis.

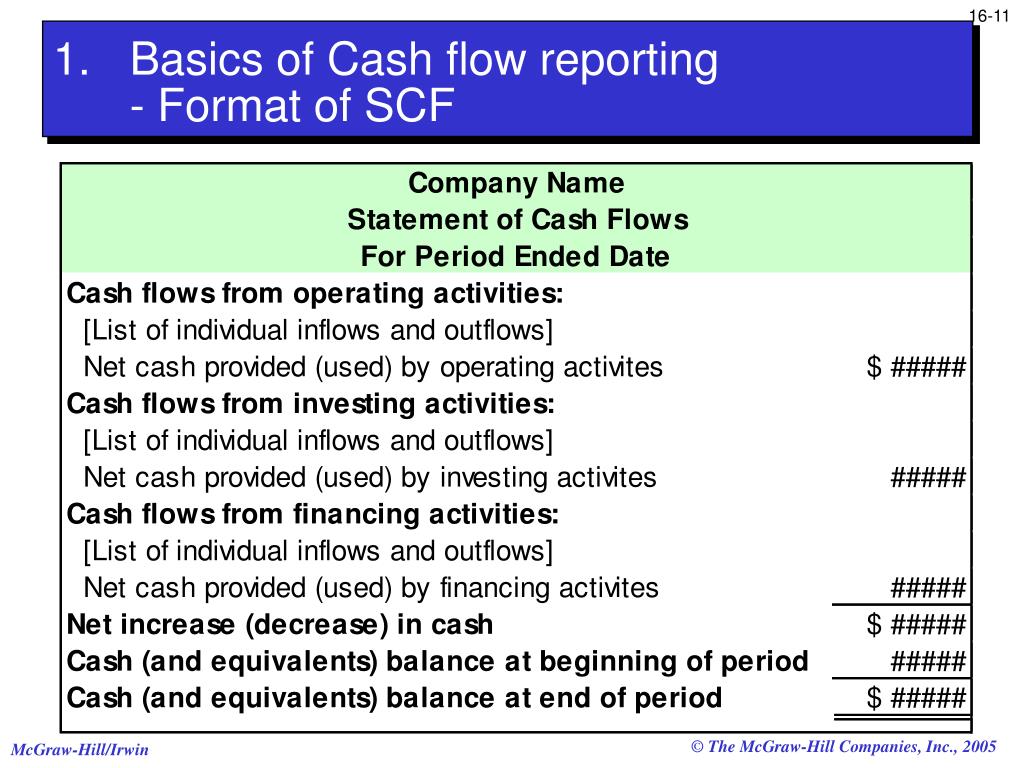

4 Format of the statement of cash flows

The first is the direct method which shows the actual cash flows from operating activities – for example, the receipts from customers and the payments to suppliers and employees. The second is the indirect method which reconciles profit before tax to cash generated from operations. Under both of these methods the interest paid and taxation paid are then presented as cash outflows deducted from the cash generated from operations to give net cash from operating activities. Cash flows from operating activities show the net amount of cash received or disbursed during a given period for items that normally appear on the income statement. You can calculate these cash flows using either the direct or indirect method. The direct method deducts from cash sales only those operating expenses that consumed cash.

Please Sign in to set this content as a favorite.

If accounts receivable increased by $5,000, cash collections from customers would be $95,000, calculated as $100,000 – $5,000. The direct method also converts all remaining items on the income statement to a cash basis. Under the direct method, actual cash flows are presented for items that affect cash flow. Solution (b) indirect methodAs we start with profit before tax in the indirect method, we have to add back all the non-cash expenses charged, deduct the non-cash income and adjust for the changes in working capital.

2: Direct and Indirect Methods for Preparing a Statement of Cash Flows

The American Institute of Certified Public Accountants reports that approximately 98% of all companies choose the indirect method of cash flows. Note that, whichever method is used, the same figure is presented as the cash generated from operations and the net cash from operating activities. Cash receipts from customers, the reporting of investing activities is identical under the direct method and indirect method. including cash sales, were $800,000. Additional informationDuring the year, depreciation of $50,000 and amortisation of $40,000 was charged to the statement of profit or loss. Present value (PV) is defined as the current or present value of all future sums of cash flow or money at a specified rate of return.

What you’ll learn to do: Distinguish between the Direct and Indirect methods of preparing a statement of cash flow

- If not too lengthy, these items can be disclosed in the notes or at the bottom of the statement.

- Because accountants deduct depreciation in computing net income, net income understates cash from operations.

- The cash received for dividend income and interest income was taken directly from the income statement since no accrual accounts exist on the balance sheet for these items.

- Additional informationDuring the year, depreciation of $50,000 and amortisation of $40,000 was charged to the statement of profit or loss.

Note that the additional information in this example stated figures related to cash receipts from customers and cash paid to suppliers and employees. You may need to determine these for yourself by using the figures in the financial statements and the additional information provided in the question. The next section to complete is the investing activities section. The analysis of all of the non-current assets accounts must also take into account whether there have been any current year purchases, disposals, or adjustments as part of the analysis. The use of T-accounts for this type of analysis provides a useful visual tool to help understand whether the changes that occurred in the account are cash inflows or outflows, as shown below. The changes in working capital (i.e. inventory, trade receivables and trade payables) do not impact on the profit but these changes will impact cash and so further adjustments are made.

Presented below is the balance sheet and income statement for Watson Ltd. If cash INCREASES, then it is a cash inflow and the number will be positive with no brackets as shown in the statement above. If cash DECREASES, then it is a cash outflow and the number must be negative with brackets as shown in the statement above.

Entities are financed by a mixture of cash from borrowings (debt) and cash from shareholders (equity). Examples of cash flows from financing activities include the cash received from new borrowings or the cash repayment of debt. It also includes the cash flows related to shareholders in the form of cash receipts following a new share issue or the cash paid to them in the form of dividends. The statement of cash flows is the most complex statement to prepare. This is because preparation of the entries requires analysis of multiple accounts.

Although Quick deducted the loss of $1,000 in calculating net income, it recognized the total $ 6,000 effect on cash (which reflects the $1,000 loss) as resulting from an investing activity. Thus, Quick must add the loss back to net income in converting net income to cash flows from operating activities to avoid double-counting the loss. Note how the current portion of long-term debt has been included in the analysis of the long-term note payable. The current portion line item is a reporting requirement relating to the principal amount owing one year after the reporting date.

The journal entry to record depreciation debits an expense account and credits an accumulated depreciation account. This transaction has no effect on cash and, therefore, should not be included when measuring cash from operations. Because accountants deduct depreciation in computing net income, net income understates cash from operations. Under the indirect method, since net income is a starting point in measuring cash flows from operating activities, depreciation expense must be added back to net income. Financing activities cash flows relate to cash flows arising from the way the entity is financed.

The items added back include amounts of depletion that were expensed, amortization of intangible assets such as patents and goodwill, and losses from disposals of long term assets or retirement of debt. EXAMPLE 1 – Calculating the tax paidCrombie Co had a tax liability of $500 at 1 January 20X1. The tax liability at 31 December 20X1 is $900 and the tax charged in the statement of profit or loss was $1,000. This article considers the statement of cash flows, including how to calculate cash flows and where those cash flows are classified and presented in the statement of cash flows. Both the direct and indirect methods of preparing a statement of cash flows will be addressed in this article. The common shares and retained earnings accounts are straightforward and the analysis of each is shown below.